Accounting Sync

This article explains how to setup your accounting platform with Cloud Depot RPS

Initially to setup the platform you will need to select your accounting provider.

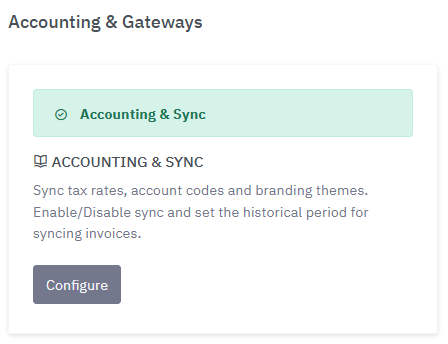

On the left-hand menu, choose Recurring Payments and then the Configuration link.

Click on the grey Configure button under the Accounting & Sync heading.

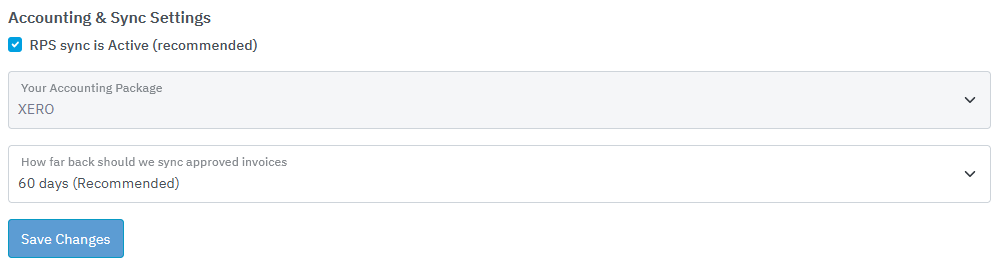

Select your accounting provider from the dropdown list, and how far back we should sync your approved invoices. We recommend at least 60 days of historical data. These will be imported into Cloud Depot.

At any time you can disable the sync by unticking RPS sync is Active

Clicking save changes will connect to your accounting provider and download the tax, account codes and branding themes required to allow the RPS system to work.

Re-sync Accounting Information

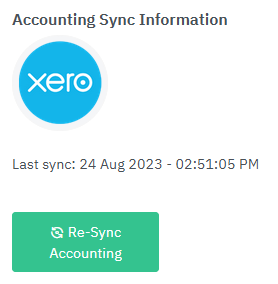

Once the initial Accounting Setup is complete, the Accounting sync information panel will display.

If at anytime you need to re-sync Accounting information such as tax or account codes, use the green Re-Sync Accounting button.

Xero Sync times

We use Xero webhooks to alert us if you have added or updated a invoice or customer in Xero. The webhook is very fast. Usually we are alerted within 30 seconds of a change, however please allow up to 1 minute for a new or changed invoice to be sync'd into Cloud Depot RPS.