Rounding Adjustment Line item in Xero

Its possible to configuration a rounding line item adjustment to your invoice. This article explain what it is and how it works.

Why are the invoice amounts sometimes different between Autotask and Xero?

How we handle this problem

If you notice small differences in invoice totals between Autotask and Xero, we can enable an option that adds a rounding adjustment line item to the Xero invoice. This line item will adjust the invoice total up or down so it exactly matches the Autotask total.

Using a rounding adjustment line item is an approved and commonly recommended Xero method for handling minor discrepancies in invoice totals, however the tax calculations by Xero will remain unchanged.

How it works

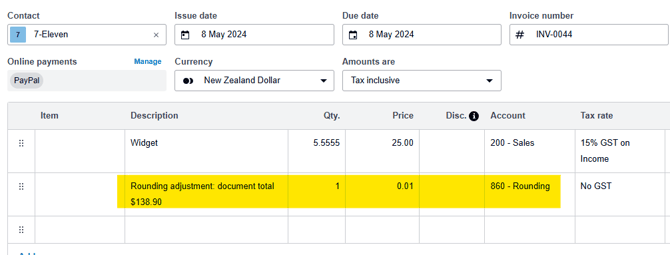

Once the invoice is generated in Xero, we compare the total of the Xero invoice with the total of the corresponding Autotask invoice. If there is any difference between the two totals, we update the Xero invoice by adding a new invoice line with the description: `Rounding adjustment: document total [Autotask total]`.

How to turn it on

This feature must be enabled by our support team. Before requesting this, please make sure you have first tried using the 4-decimal-place (4DP) rounding option.

1. Ensure that all invoices have completed syncing before reaching out to our support team to enable rounding adjustments on your account.

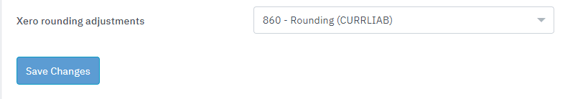

2. After enabling this feature, log in to Cloud Depot and go to the Autotask to Xero section. From there, navigate to Configuration and select Link Account Codes.

Autotask to Xero -> Configuration -> Link Account Codes

A rounding adjustment dropdown will display, select the rounding adjustment code (Xero provides a default one) Then click Save Changes

Important Note on Tax Calculations

Please note that our integration does not perform any tax calculations in Xero, nor do we override Xero's calculated tax values. All tax calculations are performed entirely by Xero's own internal engine based on the line item data provided. The outcome you see in Xero is exactly the same as if you had manually entered the invoice data directly into Xero yourself.