Rounding issues in Xero invoices

Why are there small rounding differences on my Xero Invoices?

Xero and Autotask use slightly different methodologies to calculate tax rates this can lead to minor rounding differences between the two platforms.

Turning on 4 decimal place rounding in Autotask and Cloud Depot can reduce the rounding variances between the two platforms.

You may occasionally notice a small discrepancy (usually $0.01 or $0.02) between the invoice generated in Autotask and the final invoice that appears in Xero.

This is a known behaviour caused by the different ways accounting software and standard calculators handle tax and decimal precision.

The Short Answer

Xero calculates tax on each individual line item and rounds it immediately. Most other systems (and standard calculators) add up all the line items first and calculate tax on the total.

When you have multiple lines with fractional tax amounts, these tiny rounding differences can add up to a 1-cent discrepancy.

The Detailed Explanation

1. The "Per-Line" Tax Rule

Xero creates a strictly balanced journal entry for every single line on an invoice. This means every line must independently calculate its own tax and round it to 2 decimal places before it is added to the invoice total.

2. The 2-Decimal Precision Limit

Xero restricts most currencies to 2 decimal places (e.g., $10.00). If your source system creates an invoice with high-precision unit prices (e.g., selling gas at $1.559 per litre), standard integration methods often force this number to round to $1.56.

When this rounding happens across a quantity of 1,000 items, a $0.001 difference becomes a $1.00 discrepancy on the final invoice.

How we handle this

4 Decimal Place (4dp) Support: We support sending unit prices with up to 4 decimal places (e.g., $1.5595) to Xero. This helps retain accuracy for high-precision items and usage-based billing, though Xero will still round the final line total to 2 decimal places.

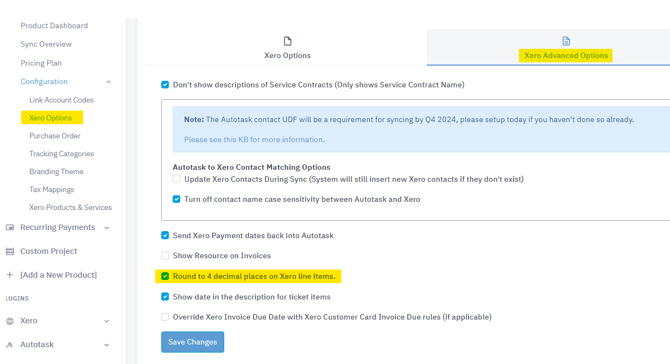

Please note four decimal place support needs to be activated in Autotask, no change is required in Xero.

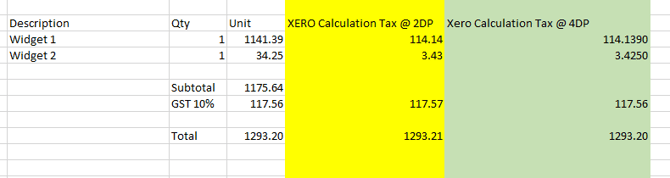

The spreadsheet below shows the impact of rounding at 2DP vs 4DP on a simple 2 line invoice.

When you absolutely need the totals to match every time.

For customers using RPS, external billing platforms, or sending Autotask invoices while collecting payments via Xero, these small rounding differences can be frustrating. In these cases, refer to the rounding line option explained below and the linked knowledge base article.

Rounding Line: In cases where setting 4 decimal place rounding above doesn't resolve the issue we can turn on for you a option to add a specific "Rounding Adjustment" line item to the invoice. Please contact support to have this turned on for you.

Xero Rounding Line Summary:

A rounding adjustment adds a separate line item to ensure the Total Amount to Pay matches your Autotask invoice exactly. It does not change the Tax Amount calculated by Xero. You should not manually alter Xero’s tax values, even if they differ slightly from Autotask. Xero is an approved accounting platform and with its underlying journal entries, the tax it calculates is considered correct and compliant for your tax reporting obligations.

Important Note on Tax Calculations

Please note that our integration does not perform any tax calculations in Xero, nor do we override Xero's calculated tax values. All tax calculations are performed entirely by Xero's own internal engine based on the line item data provided. The outcome you see in Xero is exactly the same as if you had manually entered the invoice data directly into Xero yourself.